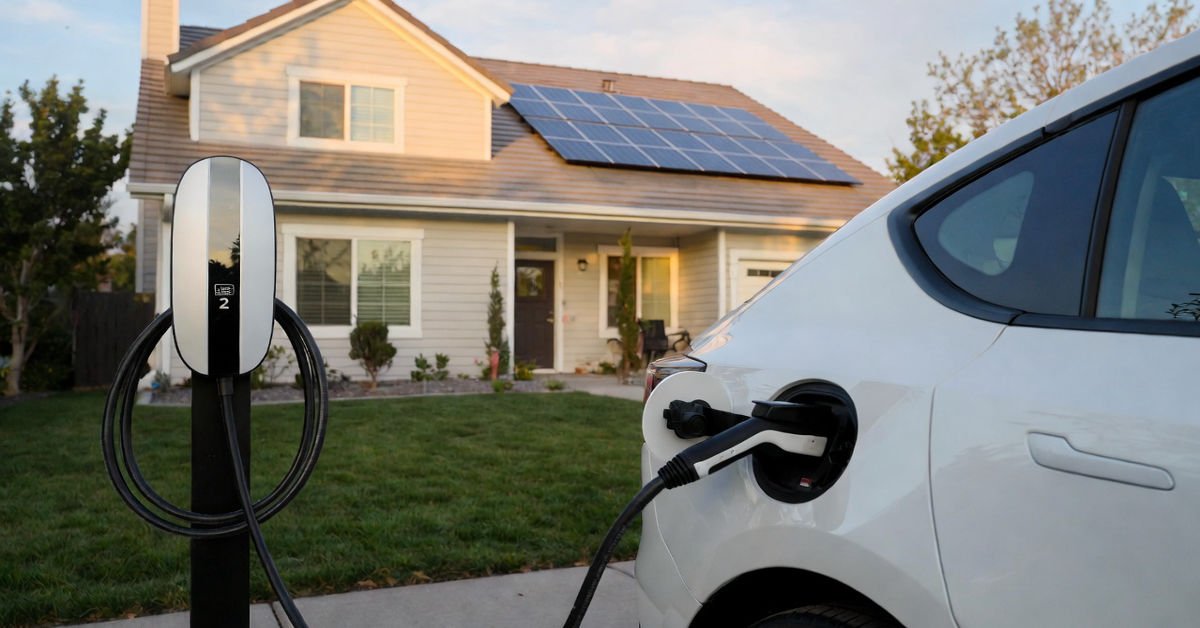

The rapid growth of electric vehicles (EVs) across the United States has transformed how Americans think about transportation and energy use. As more drivers switch from gasoline-powered cars to electric models, home charging has become a central part of the EV ownership experience. Installing a home EV charger is convenient, cost-effective, and environmentally responsible—but it can also be expensive.

To encourage adoption, the U.S. government and many state and local authorities provide financial support through EV home charger grants, tax credits, and rebate programs. These incentives reduce upfront installation costs and help households transition smoothly to clean transportation.

What Is an EV Home Charger Grant?

An EV home charger grant is a financial incentive offered by federal, state, or local governments to reduce the cost of purchasing and installing an electric vehicle charging station at a private residence. These grants may take the form of:

-

Tax credits

-

Direct rebates

-

Utility company incentives

-

Low-interest financing programs

The purpose of these grants is to make EV charging more affordable, encourage clean energy adoption, and support national climate goals.

Why the U.S. Government Supports EV Home Charging

Transportation is one of the largest contributors to greenhouse gas emissions in the United States. Encouraging EV adoption helps reduce reliance on fossil fuels and improves air quality. However, without accessible charging infrastructure, many consumers hesitate to buy an EV.

Home chargers solve this challenge by allowing drivers to charge overnight at lower electricity rates. Government grants accelerate this transition by lowering costs and ensuring equitable access to charging technology across income levels and regions.

Federal EV Home Charger Grant Programs

The main federal incentive for home EV chargers comes through the Alternative Fuel Infrastructure Tax Credit, also known as the 30C Tax Credit.

Key Features of the Federal EV Charger Tax Credit

-

Covers up to 30% of installation costs

-

Maximum credit of $1,000 for residential properties

-

Applies to both charger equipment and installation labor

-

Available in eligible low-income or rural census tracts

This incentive was expanded under the Inflation Reduction Act (IRA), which reintroduced and improved the program after previous expirations.

Federal EV Charger Tax Credit Overview

| Feature | Details |

|---|---|

| Credit Amount | 30% of total cost |

| Maximum Benefit | $1,000 |

| Eligible Property | Residential homes |

| Covered Costs | Charger + installation |

| Requirement | Must be installed in qualifying location |

| Validity | Through 2032 (subject to updates) |

Who Qualifies for the Federal EV Home Charger Grant?

To qualify for the federal incentive, homeowners must meet the following conditions:

-

Install a Level 2 or approved charging station

-

Property must be in a low-income or rural census tract

-

Charger must meet safety and electrical standards

-

Installation must be completed by a licensed electrician

-

Claim must be filed with IRS Form 8911

The federal government prioritizes expanding infrastructure in underserved communities, ensuring equitable access to EV technology.

State-Level EV Home Charger Incentives

Beyond federal programs, many U.S. states provide additional grants and rebates for EV charger installation. These vary widely based on state policy, utility providers, and budget availability.

Below is a summary of popular state incentives.

State EV Home Charger Incentives (Examples)

| State | Incentive Type | Amount |

|---|---|---|

| California | Utility rebate + state grant | Up to $1,000 |

| New York | Charge Ready NY | Up to $1,000 |

| New Jersey | Residential rebate | Up to $250 |

| Colorado | Tax credit | Up to $1,500 |

| Massachusetts | MOR-EV rebate | Up to $700 |

| Texas | Utility-based rebate | Varies |

| Florida | Local utility incentives | Varies |

Each state has its own application process and rules, so homeowners should check official state or utility websites for updated details.

Utility Company Rebates for Home EV Chargers

Many utility companies offer rebates and special rate plans to encourage off-peak charging. These incentives can significantly reduce installation costs and monthly electricity bills.

Common utility incentives include:

-

One-time rebate for charger purchase

-

Discounted overnight charging rates

-

Free smart charger programs

-

Bill credits for energy-efficient charging

Utility Incentives Overview

| Incentive Type | Benefit |

|---|---|

| Smart charger rebate | $200–$500 |

| Time-of-use rate | Lower nighttime electricity costs |

| Installation credit | Covers wiring upgrades |

| Demand response program | Bill credits for flexible charging |

Types of EV Home Chargers Covered by Grants

Not all chargers qualify for grants. Most incentive programs cover Level 2 chargers because they provide faster and more efficient charging than standard wall outlets.

Charger Types Explained

| Charger Type | Power Level | Typical Charging Time | Grant Eligibility |

|---|---|---|---|

| Level 1 | 120V outlet | 12–24 hours | Rarely covered |

| Level 2 | 240V outlet | 4–8 hours | Commonly covered |

| DC Fast Charger | Commercial only | 30–60 minutes | Not residential |

Level 2 chargers are the most practical choice for home use and are usually required to qualify for incentives.

Costs of Installing a Home EV Charger

Installation costs vary depending on home electrical capacity, distance from panel to charger, and local labor rates.

Average Installation Costs

| Expense | Cost Range |

|---|---|

| Charger unit | $400–$900 |

| Electrical upgrades | $200–$2,000 |

| Labor | $300–$1,200 |

| Total cost | $900–$3,500 |

With grants and tax credits, homeowners can reduce these costs by hundreds or even thousands of dollars.

How to Apply for an EV Home Charger Grant

The application process depends on whether you are using federal, state, or utility incentives. However, the general steps are similar.

Step-by-Step Process

-

Check eligibility for federal and state programs

-

Choose an approved EV charger model

-

Hire a licensed electrician

-

Complete installation

-

Save receipts and invoices

-

Apply for rebates or claim tax credit on your return

Documents Required for Application

| Document | Purpose |

|---|---|

| Purchase receipt | Proof of charger cost |

| Installation invoice | Labor verification |

| Electrician license | Safety compliance |

| Property address | Location eligibility |

| IRS Form 8911 | Federal tax claim |

Common Mistakes to Avoid When Applying

Many applicants lose benefits due to simple mistakes. Avoid these issues:

-

Installing charger before confirming eligibility

-

Using unapproved equipment

-

Forgetting to save receipts

-

Missing tax filing deadlines

-

Assuming all locations qualify

Careful planning ensures you receive the maximum benefit.

Future of EV Home Charger Grants in the USA

With growing EV adoption, government support is expected to continue expanding. New policies under the Bipartisan Infrastructure Law and Inflation Reduction Act are already funding nationwide charging networks.

Future trends include:

-

More incentives for apartment buildings

-

Higher rebates for low-income households

-

Integration with solar and battery storage

-

Smart chargers connected to the grid

These changes will make home charging even more accessible and affordable.

Environmental and Economic Benefits

Installing a home EV charger not only saves money but also supports sustainability goals.

Key Benefits

| Benefit | Impact |

|---|---|

| Reduced fuel costs | Save up to $1,500 annually |

| Lower emissions | Cleaner air and climate protection |

| Increased home value | Higher resale appeal |

| Energy independence | Less reliance on oil |

Is an EV Home Charger Grant Worth It?

For most homeowners, the answer is yes. Combining federal tax credits with state and utility incentives can reduce installation costs by 30–70%. This makes home charging one of the most cost-effective upgrades for EV owners.

Conclusion

The EV home charger grant in the USA is a powerful financial tool that makes electric vehicle ownership more affordable and practical. Through federal tax credits, state rebates, and utility incentives, homeowners can significantly reduce the cost of installing a home charging station.

1 thought on “EV Home Charger Grant USA”